Putin Was Right

How a conversation I had on a date many years ago explains not only the soaring energy prices, but also the crisis in Ukraine, vaccines mandates, Climate Change, and The Great Reset.

Rising Energy Prices

Unless you live in a cave and use wood to warm yourself up, there are all the chances in the world that you know that there is an energy crisis, that gas prices are way, way above the levels they were only a few years ago, and that it impacts you directly:

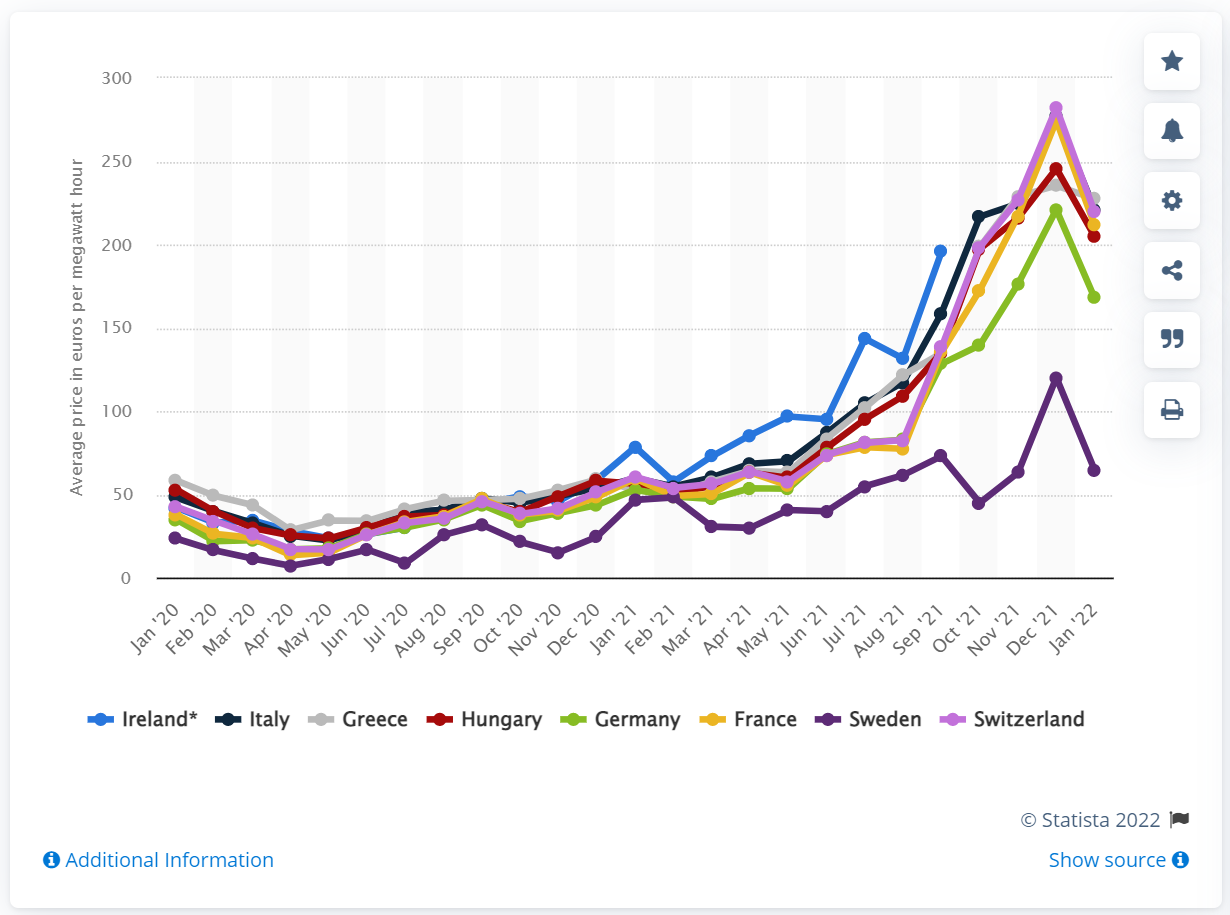

This is true especially if you are living in Europe. Here is the average monthly electricity wholesale prices in selected countries in the European Union (EU) from January 2020 to January 2022:

Today, Europe is even more dependent on Russian gas than it was in 2014. back then, Europe had a 27% dependency. Now it has a 38% dependency. Diversification has failed.

Europe is currently receiving from Russia 14 BCM per month. The European ports cannot replace that via the gas ports because they don't have the capacity to handle another 14BCM.

HUGE portion of Europe’s industry risks being wiped out by high gas prices if the bloc is forced to wean itself off Russian supplies, energy experts have warned.

However, there are also all the chances in the world that you do not know that the real reasons for the energy crisis that we are experiencing right now.

To understand what the hell is going on, allow me first to send you 15 years back in time.

6 Feet Under

Once-upon-a-time, 15 years ago, I went in Brussels on a date with a really lovely woman. She was working for the European Commission. At that point of time, it was my dream to work in the European Commission - after all, people who worked for the commission do not pay taxes, have a huge amount of vacation days, benefits , and free medical and dental insurance that most of can only dream of having. After I told her a little bit of myself I asked her about her work and she told me she is a researcher, doing research for the commission.

The European commission has what they call “A Joint Research Centre”, which is the Commission's science and knowledge service. It employs scientists to carry out research in order to provide independent scientific advice and support to EU policy.

I was really impressed. Not only she was beautiful, intelligent and funny, she also seemed to had an amazing job. I remember complementing her and telling her how lucky she was, and then she said “It’s not as great as it might seems”, which totally surprised me. OK, I knew that the European Commission has a lot of internal politics in it, like any huge organisation, but still, she was doing scientific research, so how bad could it be? I asked what she mean by that, and then she told me that the commission is one of the worse places to work for when it comes to your mental health.

That really confused me, so she explained to me that she recently finished writing a report for the commission, a position paper about the natural gas market. In Europe, most of the countries has been buying gas using what is known as long-term contracts, for about 20 years. The commission was looking into moving away from these long-term contracts and using short term contracts, to open up the market to competition, and her organisation assigned her to write a report. She told me that for the last year she was busy travelling all over Europe to gain the understanding of the current situation and what does the countries position is. She was barely at home, going from one country to another, practically living in hotels. After many many months of meetings she submitted my report, which was that European countries should continue using long term contracts. And then she said that because this is not what my boss wanted to hear, he buried the report.”

“What do you mean buried it?” I asked.

“It is gone. It’s filed, archived, this report will never be presented to anyone. It will never be discussed, and all the months of works and all the effort was for nothing”. She told me that this was not something unusual, that it was happening all the time, and that she had two options - shut up and just continue working, or quit her job and risk losing the golden cage she was in. She added “This is why I told you that the European Commission is a horrible place to work for when it comes to your sanity. Really, it is not as great as it seems”.

We continued our conversation, we had dinner, we said goodbye, I never saw that woman again, and frankly I did not remembered that date.

Until Russia entered Ukraine.

The Rabbit Hole

As I was trying to figure out what the hell is going on in the world, I stumbled upon a transcript of a meeting that took place in Russia last year, which was led by Putin.

Reading it sent me down a rabbit hole of researching a topic I knew little about, which is the energy market and in particular natural gas.

The more I was researching, the more it became the scale of the energy crisis, who was behind it, and how it all relates to everything we see happening in the world.

BUT BEFORE WE CAN TALK ABOUT THE RUSSIAN MEETING, LET US GO OVER WHAT IS GOING ON IN EUROPE WHEN IT COMES TO ENERGY AND IN PARTICULAR THE GAS MARKET.

The Long Short

We will start with a look on the way energy markets in the world are operating and in Europe. It might surprise you, but according to Reuters, “70% of LNG (Liquefied Natural Gas) trade globally is estimated to be sold via long-term contracts”.

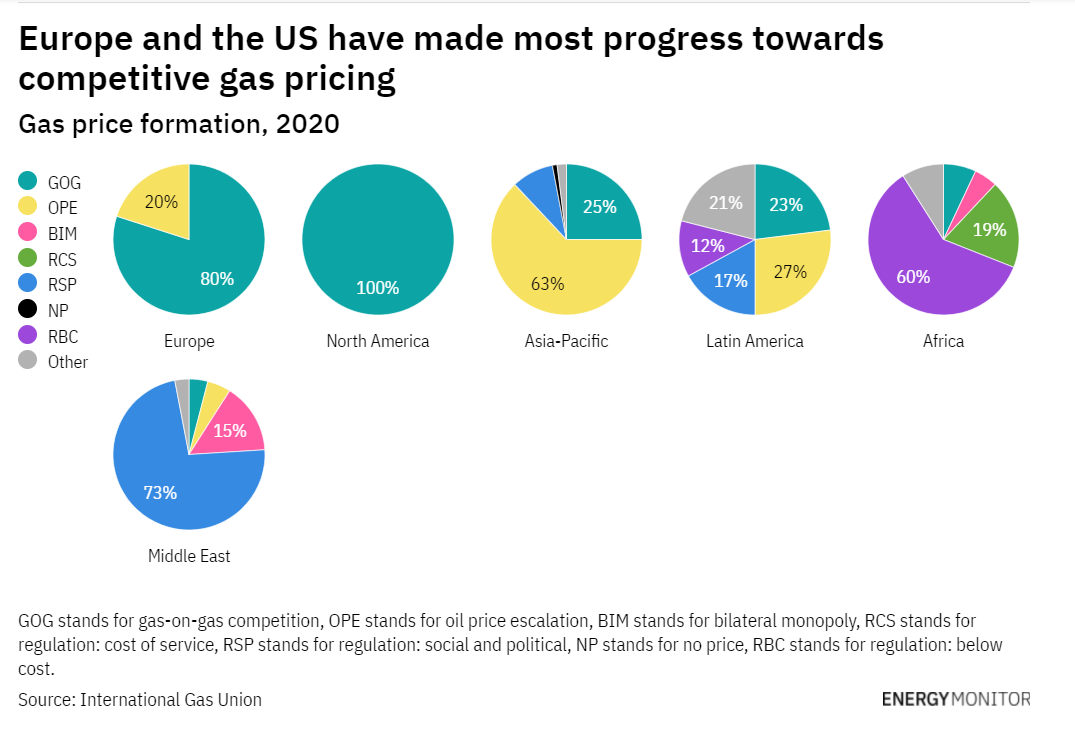

In Europe, 80% of the gas pricing is based on short-term contracts. In the US it is 100%.

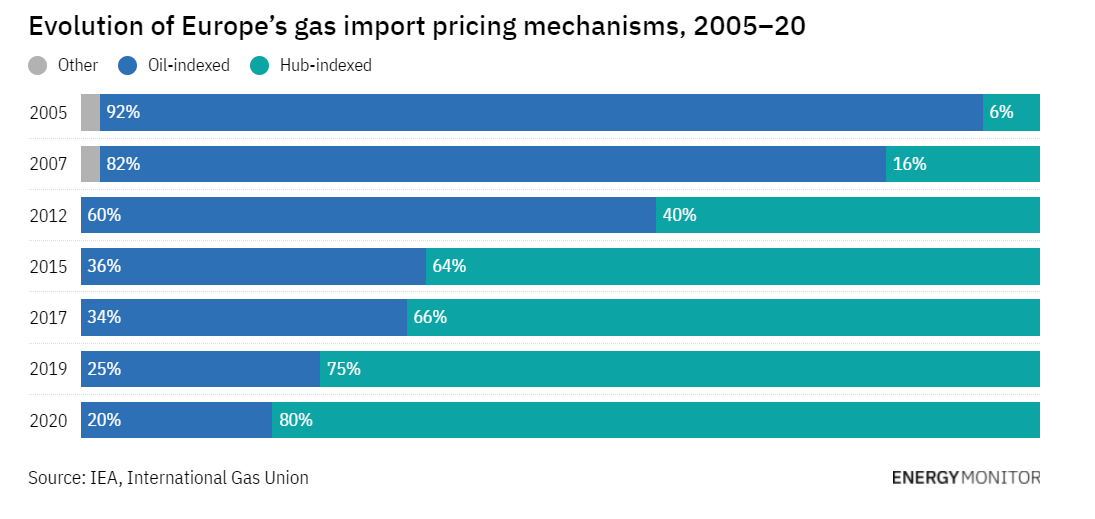

The movement to the an energy market that is based on short-term trading was led by the European Commission, and has been accelerating since 2007, which confirms what I was told in the date I had 15 years ago.

And since the European Energy market is being shaped by the European Commission, rather than on a state level, any crisis in the gas market that is impacting European citizens is a result of the European Commission decisions.

A Confession of an EU Delegate

Why are the prices so high?

On the 17th of January 2022, the financial times has published a letter by Professor Jonathan Stern, a distinguished Research Fellow in the Oxford Institute for Energy Studies who was an EU Speaker for the EU-Russia Gas Advisory Council during 2011-15. It was entitled “Europe’s energy crisis should not be blamed on Gazprom”. Gazprom, to those who don’t know, is Russia’s national gas company. All exports of gas is being done by doing business with Gazprom.

In it, professor Stern wanted to make it clear that the responsibility for the current European gas market model, which has produced the high price levels of the past year, is on the European and not the Russian.

In his article he explained that 10 years ago an EU-Russia Gas Advisory Council was created to discuss with Gazprom the implications of the new gas policy which was called the EU “third energy package”. He recalled that for months the Russians told the European that abandoning long-term contracts and moving from oil-linked to market prices were extremely bad ideas. He admitted that the European has disregarded these warnings, focused on creating a trading market, and moved away from long-term contracts that were oil-linked to spot prices. He said that for 10 years they were right (aside from a very few months) as the hub prices were substantially below those related to oil.

Professor Stern adds that even as recent as May 2020 long term contracts were nearly six times those at SPOT hubs, which were at historical lows, that no one wanted to sign long-term contracts, and that Gazprom was losing money on their gas exports. However, he added, from the end of 2020 that situation changed, and even though Gazprom has consistently invited European companies to sign new long-term contracts, very few did.

Professor Stern explains that because of national and corporate greenhouse gas reduction targets and policies long-term commitments are increasingly untenable. He again stating that this was a European choice, that it was not imposed or created by Russia. He adds that complaints that Gazprom is refusing to make additional supplies available fail to recognise the fact that the current market model contains no obligation to do so. He said that none of this is to deny that there are geopolitical motivations related to Nord Stream 2 and the general state of relations with Europe. He ended up by saying that for 10 years the gas market model benefited European consumers. For the past year the opposite has been the case and Gazprom (and all other suppliers) has reaped the benefits.

So what did we learn?

The European Commission decided to move to short term contracts.

The Russians tried to tell them this is a bad idea.

The Commission’s representatives refused to listen.

EU Energy market - Past, Present, Future

To understand how we have such high energy prices in Europe, let us start with an overview of the energy market.

The European energy market is shaped by decision that were taken and are being taken by the European Commission, which, to those who don’t know, is not a democratically elected body.

The European Commission leadership were pushing to move away from long-term contracts and created an European Energy “free” market that was supposed to integrate allow Europe to be more like… well… the US (when it comes to competition). This has been done via what the Commission called “Energy Packages”, which are directives (legislations) that were introduced in 1998, 2003, 2009, 2019, and the latest was introduced in July 2021.

Sounds like the EU was moving forward, so why do we have such high energy prices?

Because the EU did not want to listen to any warning, that’s why!

In a paper that was published in 2005 by Karsten Neuhoff who was from the faculty of economics in Cambridge University and from Christian von Hirschhausen Dresden University of Technology, entitled “Long-Term vs. Short-Term Contracts: A European Perspective on Natural Gas”.

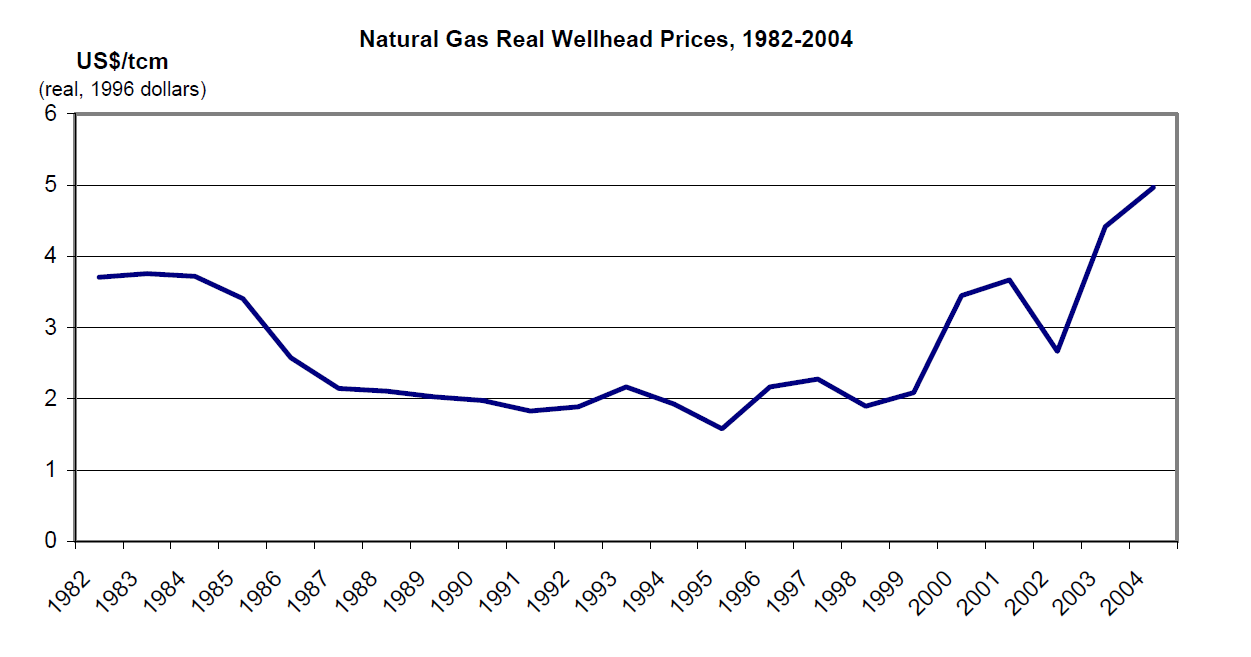

Here is what happened in the US as a result of opening the market. It led at first to reduction in prices but it ended up with a stiff rise in energy prices:

The authors concluded that:

“Lessons from the U.S. suggest that the scope for long-term contracts is reduced in the aftermath of liberalisation. However, as time passes on, supply may become shorter, prices may rise, and large consumers and wholesale traders may become weary of the situation, and are then more willing to re-engage in long-term contracts. Our model shows that producers also have a strategic incentive to engage in long-term contracts if long-run price elasticity of demand is significantly higher than the short-run demand elasticity.

Given the structural changes that the European natural gas industry is currently undergoing, one can conclude that long-term contracts will remain an important element of the European natural gas industry, but that in the short term, their role in the supply mix is likely to diminish. The relevant policy question to which our paper hints is: what institutional arrangement would be most appropriate to ensure that one can sign long-term contracts with producers in gas-exporting countries, while at the same time reaping the benefits from gas sector liberalisation?”

This brings me back to the claims that were made by the woman I was on a date with, that there were voices that raised concerns within Europe to move the market to a short term contracts. In 2007 the European Commission knew about the consequences of turning the natural gas market into short-term contracts based in the US, that is only beneficial for the short term, but they decided to ignore it.

The European Commission knew about these risks, but they didn’t care.

Speculative Failure?

But could there be any other reasons that impact the high prices? Is the market being manipulated?

According to the Daily Mail, in an interview to The Times on February 2022 a Shell executive vice president stated that “One of the other factors that also played into the high European prices and volatility we saw last year was the increased financial activity, and in particular a lot of new financial players like hedge funds coming into this market. Historically, these players have operated in crude oil markets and Henry Hub [American gas] markets. But we saw a big introduction of new financial players bringing money in and out of European gas markets, and that increased volatility and uncertainty in those markets.”

Even the European Commission president Ursula von der Leyen told the European Parliament in Strasbourg on October 2021 that "We must end speculation on the energy markets, that is why we are we are increasing our monitoring of the gas and energy markets".

No MANIPULATORS here!

In Europe, the energy regulation is called REMIT (Regulation on Wholesale Energy Market Integrity and Transparency) and the regulatory body is called ACER (Agency for the Cooperation of Energy Regulators). REMIT prohibits ‘any engagement in, or attempt to engage in, market manipulation on wholesale energy markets’. It defines two forms of manipulation: ‘market manipulation’ and ‘attempted market manipulation’, and four types of activity. The first 3 types involve the issuance of an order or the entering into a transaction, the last is trying influence the market indirectly:

giving false or misleading signals by trading, or placing orders to trade, which gives, or is likely to give, false or misleading signals as to the supply of, demand for, or price of wholesale energy products;

securing the price at an artificial level;

using fictitious devices, deception or contrivance;

disseminating false or misleading information

In ACER’s October 2021 released a note about “High Energy Prices”, and in it the agency claimed that: “it is unlikely that any specific and repetitive market trading behaviour would have a significant impact on such high prices”.

In November 2021 ACER published a longer report, and claimed the following:

“Europe has a robust framework, REMIT, to detect and prevent energy market manipulation and insider trading. Market manipulation and its effects may occur across borders, between electricity and gas markets and across financial and commodity markets, including the emission allowances markets. Under REMIT, ACER carries out EU-wide wholesale energy market surveillance whilst the national regulatory authorities (NRAs) for energy investigate and enforce potential instances of market abuse. As was also stated in ACER’s Note in October, based on the information and data available to ACER, currently there is no obvious indication nor evidence of systematic manipulative behaviour or insider trading under REMIT likely to affect the current high-energy price situation. Surveillance is ongoing. … The European Council (21-22 October) invited the European Commission to study the functioning of the gas and electricity markets as well as the EU ETS with the help of the European Securities and Markets Authority (ESMA)… ”

Let us recap ACER’s claims:

specific and repetitive market trading behaviour are unlikely to cause the high prices.

and that based on the information and data available there is no no obvious indication nor evidence of:

systematic manipulative behaviour or insider trading under REMIT

NOTICE THE LANGAUGE and ask the following questions:

What does “specific and repetitive market trading behaviour” means?

What “information and data available” to ACER?

What is an “obvious indication”? What is the “evidence” that ACER has so far?

Why did ACER use the term “systematic” when they describe “manipulative behaviour or insider trading” and what does it mean “under REMIT”?

First notice that ACER is talking about MANIPULATION. ACER does not make any statement whether or not the market is being driven by SPECULATORS who via their actions can manipulate the price, BECAUSE ACCORDING TO THE REMIT DEFINITION THAT DOES NOT CONSTITUTE A MANIPULATION.

Don’t Mention the Exchange!!!

Let us start with the speculators and where do they operate.

If you read Acer November’s statement, you’ll notice that ACER is mentioning ESMA. According to their website, “The European Securities and Markets Authority (ESMA) is an independent European Union (EU) Authority that contributes to safeguarding the stability of the EU's financial system by enhancing the protection of investors and promoting stable and orderly financial markets.”

Europe has multiple gas exchanges, which like “normal” stock exchange allows a shipper or trader to buy or sell gas without the other party to the gas transfer being known to the shipper or trader, while traditionally trading in gas was done in an Over-The-Counter (OTC) form, where both the seller and the buyer knew who they conduct the deal with.

These exchanges are supposed to be govern by ESMA.

Here Comes The Big Sharks

Let’s see what’s going on in these gas exchanges.

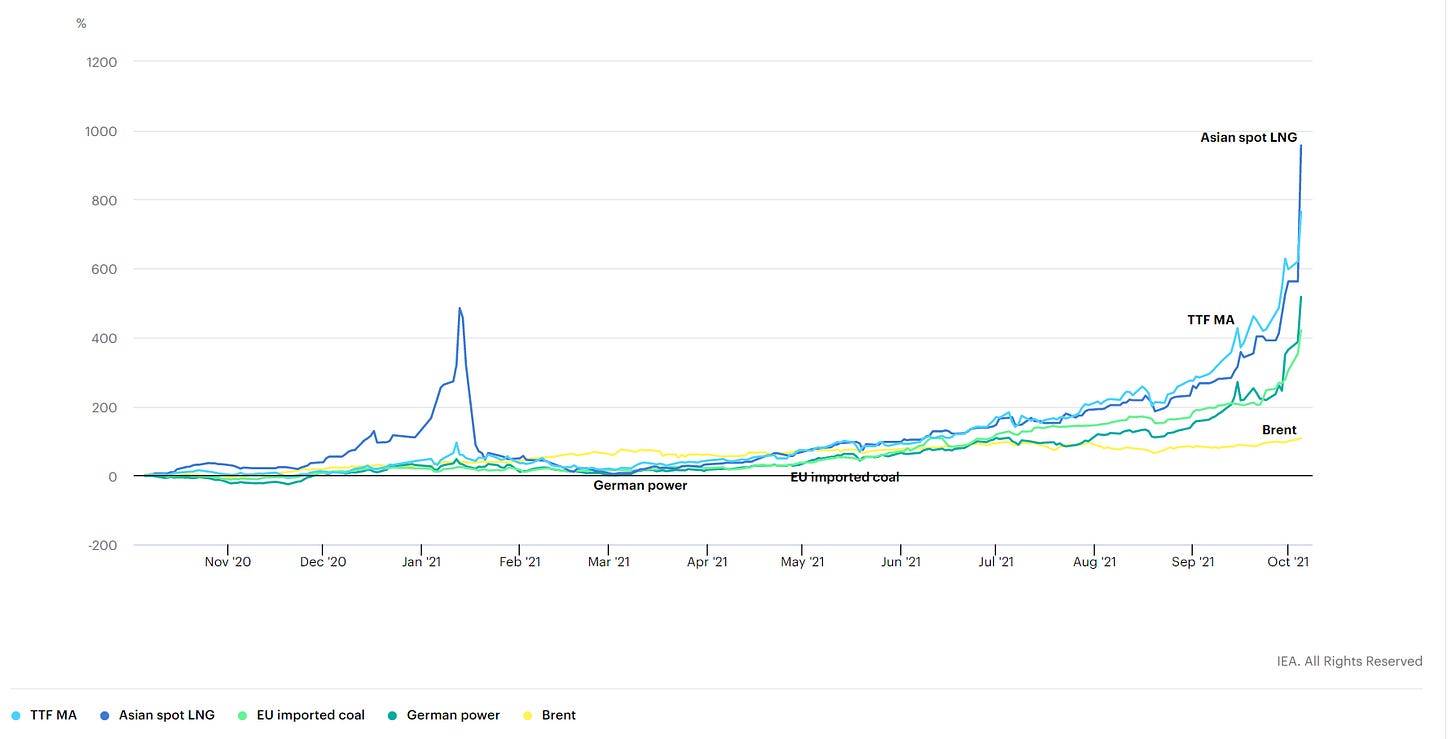

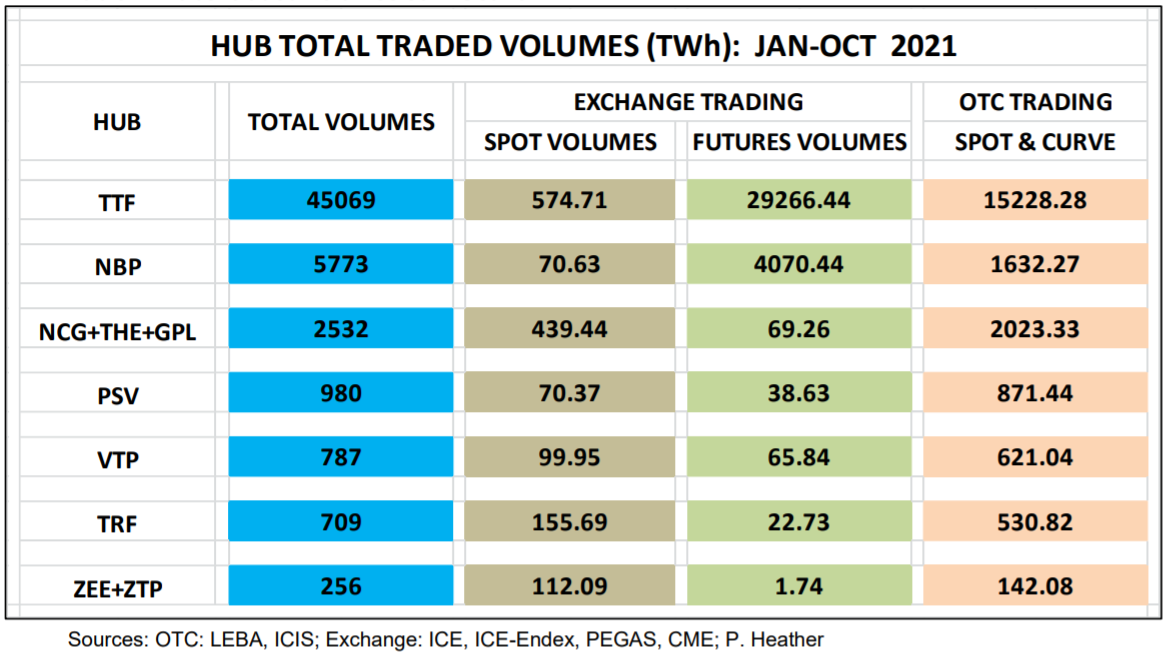

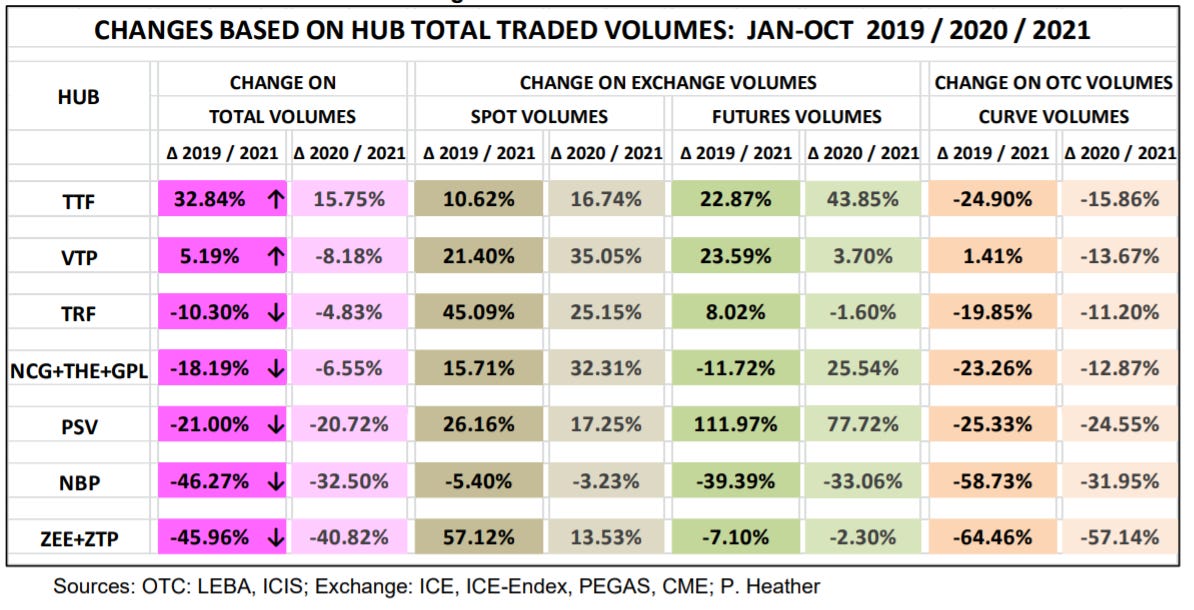

First let’s look at an indication which is the total traded volumes of gas in the energy exchanges, and in particular let us look at trading on future volumes of gas. Spot trading are trading “in the now”.

Notice that future volumes are being traded in the exchange more than OTC trading, meaning more than actual trading of gas that is actually used.

More importantly, notice that future trading has grown substantially compared to the previous year. For example, future volumes represented in 2021 the biggest volume of trading in the TTF gas hub which is located in the Netherlands (43% increase).

According to Cyril Widdershoven article from October 2021, the “current price spikes are not abnormal if it is understood that ALL FINANCIAL PLAYERS HAVE BEEN BETTING ON HIGHER PRICES SINCE THE BEGINNING OF THIS YEAR. Goldman Sachs pitched a commodities “supercycle” in April 2021, JPMorgan followed a bit later. All other major financials followed suit very soon after, leading to a legal but pushy energy price spike expectation. These forecasts were made even at times when physical markets, oil especially, did not demonstrate crude oil shortages. As several analysts repeatedly stated, US markets don’t need a lot of crude oil storage. Fluctuations in the USA were seasonable. At the same time, storage reports in Fujairah, Singapore, and Japan, indicated “normal” physical storage situations.”

Life Sachs!

According to the Financial Times, Goldman Sachs’s prime brokerage division told its clients in October that hedge funds has had their biggest buying of energy stocks since February 2020. Goldman Sachs advised its clients and told them to do the same. While big institutions, pension funds, charities, churches, other faith groups, and universities were trying to embrace “green policy” and get rid of their investments in what was perceived as companies which are bad for the environment, financial institutes were focusing on buying these “bad” energy stocks because they knew they are going to make a huge profit. If you want to read more about the advice, see here.

To those who don’t know what a hedge fund is, it is “a general, non-legal term that was originally used to describe a type of private and unregistered investment pool that employed sophisticated hedging and arbitrage techniques to trade in the corporate equity markets."(“Hedge funds change energy trading” by Peter C. Fusaro and Gary M. Vasey from 2005).

Speculation is not a bug, it’s a feature!

Is it legal? Sure is.

Well, first let us start with FACTS. In a report submitted to the European Commission Directorate-General for energy in 2020, entitled “Study on energy prices, costs and their impact on industry and households”, it clearly stated that:

“The core market elements are the forward market, the day-ahead market, and the intraday market. The intraday market aims to secure real time supply, the day ahead market serves to optimize scheduling of resources, and the forward market allows participants to exchange weekly, monthly, quarterly, and yearly products. All products can be used to sell generation outputs, procure electricity, and for speculative or hedging purposes. Exchanged volumes per product type can vary between countries/markets.”

Samantha Dart, Head of Natural Gas Research at Goldman Sachs, speculated (analysed) that the price of gas will be high.

Those who followed her advice speculated the price will be high, and rushed to buy gas future options, hoping to make money out of it.

Since the majority of the gas in Europe is not supplied via long-term contracts anymore, this rally of buying future options has led to increase in demand, which made the price higher.

According to REMIT this is not consider to be misleading information because she is an analyst.

according to ACER’s latest REMIT guidance (6th edition), Goldman Sachs advice did led to an manipulative activity called momentum ignition, which is “entering orders to trade or a series of orders to trade, or executing transactions or series of transactions, likely to start or exacerbate a trend and to encourage other participants to accelerate or extend the trend in order to create an opportunity to close out or open a position at a favourable price”. However, because those who did it “simply listened” to Goldman Sachs speculation they can claim they just followed an advice and therefore they were not the one who initiated anything.

HOWEVER, according to ACER’s latest REMIT guidance (6th edition), “the fact that REMIT is applicable to a certain situation or behaviour does not prevent the application of European competition law to the same situation or behaviour… While REMIT prohibits market manipulation under Article 5, competition law prohibits agreements between companies which prevent, restrict or distort competition in the EU and which may affect trade between Member States”. As I said before, when you read a reply, ALWAYS see what is missing…

If financial institutes agree to buy gas at a higher price in a way that prevent, restrict or distort competition (of the energy market) in the EU, because it cause the price of gas to rise, isn’t it a market manipulation? Apparently not if you follow an advice of an analyst from Goldman Sachs.

Algorithm Attack

So the Goldman Sachs “analysis” brought a lot of new players who wanted to make money. This volatile market brought into light another form of trading - algorithm trading, also know as quant, or algorithmic trading.

According to Blumberg, “funds that use computer-driven algorithms to bet on niche or “exotic” markets such as Dutch and British natural gas or Spanish and German power demand have turned the surging energy costs sweeping the region into one of their biggest recent money makers.”. For example, a 950 million dollars fund named Gresham Quant ACAR made a 38.5% gain on their bets, and a 4.8 billion dollars fund called Systematica Alternative Markets Fund made 23% profit. The market manipulation was also covered in an article entitled “How “explosive” energy prices are fuelling a quant hedge fund surge” that was published in HedgeWeek on October 2021.

The times had similar coverage on the trend in its article “The City power players making money from the energy crisis”, and in it the Times has wrote that “Other more speculative investors have also attempted to profit from the wild price swings, without actually dealing in physical gas. On exchanges such as ICE and EEX, they usually trade options contracts and “futures”, buying gas for delivery at a future date and selling the contract before delivery is actually due, hopefully to make a profit. Quantitative hedge funds — which use algorithms to predict opportunities in certain financial markets — dominate that corner of the market. They were quick to spot that prices were about to surge.”

I Know NOTHING!!!

This brings us to the obvious question: how much algorithm trading is out there in the gas market?

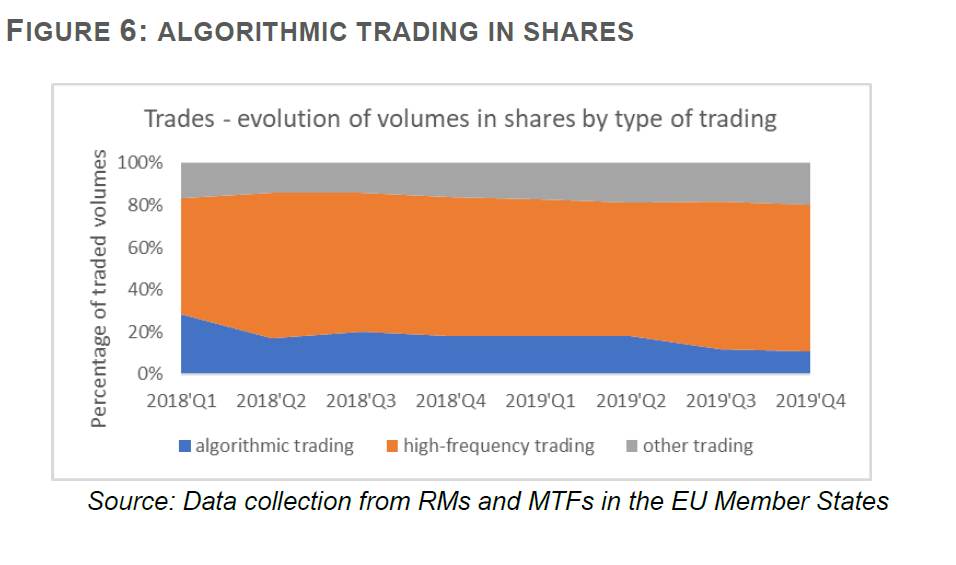

Let us look at other exchange markets. From an ESMA report (which we will discuss in a minute), at the end of 2019 about 60% of shares trading in Europe is done using what is known as High-Frequency Trading (HFT), which means EXTREMELY FAST computers located VERY CLOSE to the exchange to trade before everyone else can and using information no one else has yet, and around 10% were done by computer algorithms which were not that fast as the HFT ones:

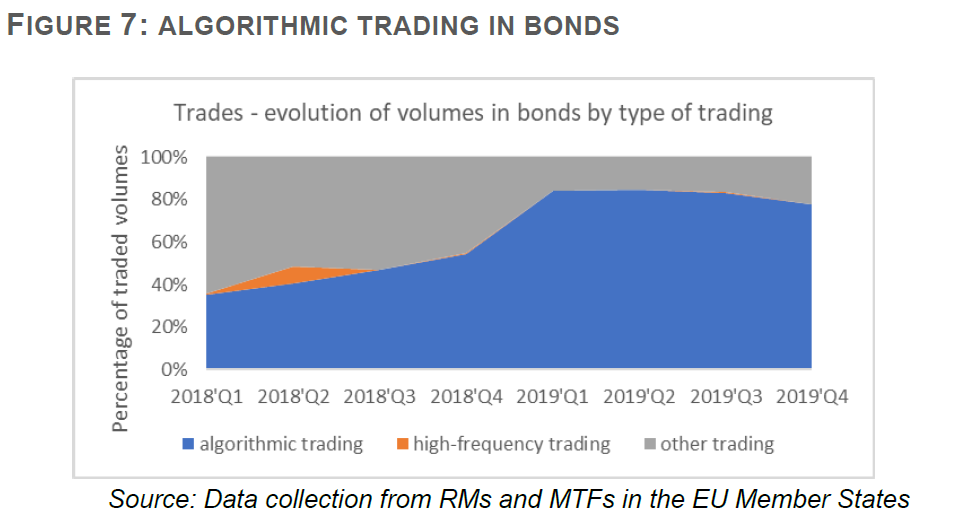

In bonds, the situation was different, as ESMA state probably due to less liquidity, but still by the end of 2019 around 80% of the trade is via algorithms.

What about the energy market?

According to this blog from 2020, “some European power spot markets recording over 65% of trades being performed by algorithms”.

According to Reuters article in August 2019, “More than half of the electricity traded on the Nord Pool power exchange’s intraday markets in July, a record 52% of the volume, was executed by computer algorithms as trading houses sought to gain an edge in an increasingly complex energy market… up from just 13% of volumes in the same month of 2018”.

If you ask yourself what is the situation in the energy exchange market, well, as far as I can tell, there is no official report on it - neither from ACER, nor from ESMA.

What we want? Regulation! When we want it? 0.00000001 second ago!

If you say to yourself: “well, I could understand that you can’t stop speculations, but this algorithm trading… isn’t there an element of manipulation there?”

Well, you are lucky because the European Commission’s European Securities and Markets Authority (ESMA) was required to deliver a report about algorithm trading by the 3rd of March 2020. however, only in December 2020 ESMA launched a consultation in order to seek input from market participants on the impact of of algorithmic trading, including high-frequency algorithmic trading (HFT).

ESMA got response from banks, investment firms, exchange and trading systems suppliers, Regulated markets, exchanges & trading systems, fintech and well, ESMA’s report was published in September 2021, and ESMA concluded that “no fundamental issues have emerged with respect to the MiFID II algorithmic trading regime which has overall delivered on its objectives.”.

The same way the regulators and the pharmaceuticals told us that the COVID19 experimental gene therapy treatment (AKA “vaccines”) are safe and effective because they consulted each other, the regulator and the financial institutes involved in the trading has consulted each other and saw no problem. Nothing to see here…

Terminator: The Darker side of Algorithms

Let's start with a thought experiment:

If a legal flaw exists and no one talks about it, does anyone who uses it to cause harm is really acting unlawfully?

Like in the case of using Codon Optimization technology when creating the COVID19 experimental gene therapy treatment (AKA “vaccines”), where both the regulators and the manufacturers knew there are risks but has chosen to simply ignore them as if they do not exist, algorithm trading creates a legal loophole which endanger the market.

In Volume 74 of the Vanderbilt Law Review from March 2021, Gina-Gail S. Fletcher, professor of Law in Duke University, published an article called “Deterring Algorithmic Manipulation”. In the article professor Fletcher claimed that the existing anti-manipulation frameworks do not effectively deter algorithmic manipulation. While initial algorithmic trading relied on a pre-set of electronic instructions to execute trading strategies, the use of artificially intelligent (“AI”) trading algorithms that can learn dynamically from data and respond intuitively to market changes have exposed significant shortcomings in the effectiveness of anti-manipulation laws, particularly regarding one of their fundamental goals: deterring market manipulation.

In artificially intelligent machine-learning algorithms, the programmer sets a goal for the algorithm to achieve in solving a problem, and eventually there is a causal connection between the programmer’s intention and the algorithm’s ultimate actions, “layer of abstraction” between what the programmer expects and what the algorithm does, which makes the neural networks that the AI created into a black box to the programmer and to anyone investigating it.

So, even though deterring algorithmic manipulation is essential to the viability and stability of the market, it is becoming increasingly unattainable to have a credible and effective deterrence of wrongdoing with respect to algorithmic manipulation under the existing legal regime.

In her article professor Fletcher raised 3 scenarios for algorithm misuse:

The Easy Case: Deliberate Misuse of Algorithms - traders programmed their trading algorithms to deliberately distort the markets. easy to prove manipulation.

The Medium Case: Open-Market Manipulation & Unintended but Harmful Distortion - an algorithm cause an unexpected distortion as result of a failure to properly design and test the algorithm before installation, a failure to properly monitor and respond to warning signs of potential, or a mistake in the algorithm’s code. Harder to prove deliberate manipulation.

The Hard Case: Rational Distortion & Independent Misconduct - The AI / machine-learning algorithms can distort the markets as part of their dynamic learning and decision-making process. Impossible to prove manipulation.

Anti-manipulation legal frameworks connect the liability to the person who knowingly conduct the manipulation , but that you cannot assign it to algorithm based on AI, and that it is impossible to identify the intent of the human being behind the AI algorithm. She warned that because the current anti-manipulations frameworks rely on the intent, the rise of AI diminishes the disciplinary power of the law, weakening deterrence, and incentivizing algorithmic manipulation.

The subject was covered before, in a computerworld article called “How do we legislate for AI in algorithmic trading?”. Allow me to quote: “MiFID II took effect in January 2018, and requires testing and pre/post trade controls, as well as a 'kill functionality' to be put in place to prevent algorithms contributing to market disorder or market abuse. Firms must also keep records, "with a description of the nature of its algorithmic trading strategies, details of trading parameters or limits, key compliance and risk controls and details of testing." The FCA then regulates algorithmic trading firms to ensure they meet these standards. But MiFID II is pretty vague about what goes on under the covers, stating that compliance staff must "have at least a general understanding of the way in which the firm's algorithmic trading systems and algorithms operate, and that they be in continuous contact with those who have a detailed knowledge of the latter." And there is little mention of cutting-edge techniques like machine and deep learning.”

ACER and Algorithms

What about ACER? Does ACER looks at algorithms and their impact on the trade?

As far as I know, ACER did not provided any guidance or published any analysis on the level of algorithmic trading in the energy market. ACER also did not provide any guidance about the use of machine learning / artificial intelligence and the energy market. As I said above, if a legal flaw exists and no one talks about it, does anyone who uses it to cause harm is really acting unlawfully?

The ACER Metrics for Forward Markets

Let’s look at ACER and their metrics.

In September 2015, the European Commission’s Agency for the Cooperation of Energy Regulators (ACER) received a report (which I assumed they commissioned) from “Economic Consulting Associates”, a specialised economic consultancy located in London. The report, which was called “European Electricity Forward Markets and Hedging Products – State of Play and Elements for Monitoring”, was supposed to “provide insights regarding the functioning of forward markets, the availability of hedging products in the EU and to investigate potential indicators for monitoring the impact of the FCA NC’s implementation on transfer capacity forward markets”.

According to the report, REMIT requires market participants to report wholesale energy market trades, records of transactions, including orders to trade, within the EU to a Registered Reporting Mechanism (RRM).

The report stated that the majority of forward trades are brokered rather than being settled on exchanges. The report stated that without implementation of the Regulation on Wholesale Energy Market Integrity and Transparency, or in short REMIT, it is difficult to fully quantify the volume of brokered trades.

According to the report, the main price reporters offered comprehensive snapshot reports on prices in several markets but did not provide comprehensive information on the volumes behind those prices. The report stated that “pure traders, trading arms of larger utilities and financial intermediaries will use both physical and financial products (both energy and transmission rights) as speculative instruments. Such players perform a vital role in developing liquidity, price discovery and price formation in forward markets but should not directly influence price fundamentals.” and claimed that having high number and diverse range of market participants “including ‘speculators’ or financial intermediaries” is an indication of low barriers to entry and can help contribute to the formation of robust forward prices” because it will “bring increased liquidity”.

When it came to metrics, ECA extracted from the literature the monitoring metrics that were employed to assess the effectiveness of forward markets.

The metrics they recommended as essential where:

For turnover: volume/value

For Churn rates: Ratio

For Bid-Ask spread: Absolute €/MWh or % of price

Reporting of trades: Price

Minimum number of companies needed to reach 50% market share in production/ number of contracts traded: Index

The following metrics were defined as “useful”:

Open interest: Volume of unclosed positions

Volume of bids and offers: MW

Share of longterm hedging in total open interest: %

Demand/supply publication: MW

OTC contracts with force majeure and suspension clauses: %

Market participant churn: %

Entrance trading fees: %

Presence of market makers: Yes or no

Granularity: Clip size relative to sixth or smaller supplier

Share of biggest 5: %

Concentration ratios

FTRs held by financial entities: %

Volume by trader type: %

ONLY THE LAST 2 METRICS, WHICH WERE DEFINED ONLY AS “USEFUL” had the capability provide ACER with some sort of indication of market manipulation. For your information, FTR stands for Financial Transmission Right which is a contract to receive the difference in price between two locations on the transmission network for a particular quantity (MW) at a particular time.

When it came to the % of FTRs held by financial entities, ECA claimed that while it is used in the US and is easy to measure, it is difficult to interpret because “in the PJM market, the interest in the market was driven by underfunding speculation rather than offering hedging services.”, and said that “This is a very specialised measure and only applicable to very few markets. It is also not clear if there is a correct proportion of financial players in the FTR market. We have no recommendations for this metric.”. However if you dig down the report you would have discovered that it clearly states that “the percentage of FTRs held by financial entities as opposed to physical entities provides an indication of increased liquidity and extent of speculation.”

When it came to the % of volume by trader type, which was monitored in New Zeeland, it claimed the advantage of it was that it captures the extent to which the market is “supported” by diverse parties, but claimed that the disadvantage was that there is a definitional issues because “parties could be in more than one category” and therefore the interpretation of the data is difficult, and that the dominance of financial parties may mean an absence of physical players (in case of vertical integration). They concluded that it was not clear whether a metric applicable across Europe would be useful because “there is no way of determining the correct numbers”. They concluded their statement that “In reality, the issue is about the presence of smaller parties in the physical market and whether they are accessing forward markets”. Again, if you dig down in the report you will find that “it may also mean an absence of physical players”, but it did not mention the fact that it can be an indication of the market being run by speculators.

The summary of this report was given via a presentation that stated that the energy market allowed participants to hedge risk “in order to compete effectively”.

Their conclusion was that forward trading is complex and multi-faceted, that there was a need for much data and careful interpretation, that there is a need for monitoring, but that Monitoring metrics are not well designed for European forward markets, that there is a lack of monitoring tools assessing the underlying relationship between forward and prompt markets, that the only monitoring tools that they recommended to ACER were limited to time series analysis and benchmarking, and that they don’t really know if this market is working effectively.

AS YOU COULD HAVE GUESSED, both the % of FTRs held by financial entities AND the % of volume by trader type WERE NOT SELECTED AS METRICS, leaving the regulator (ACER) to be as blind as a bat when it comes to be able to measure and therefore understand what’s actually going on in the market.

No Metrics, No Cry?

I ask you to re-read ACER statements:

specific and repetitive market trading behaviour are unlikely to cause the high prices.

and that based on the information and data available there is no no obvious indication nor evidence of:

systematic manipulative behaviour or insider trading under REMIT

Now, after all that you have read, let us look back at the statements above and ask:

What were the risk scenarios they were looking at?

What were their Key Risk Indicators?

What were they monitoring and how were they monitoring?

What were the Key Performance Indicators?

Since we simply do not have any clue, and since based on the decisions that the regulator has taken so far with regards to risk management of the energy market when it comes to speculators and algorithmic trading, it brings up the following question: is the fact the regulator cannot see anything is because there is nothing there, or because they decided no to define the risk scenarios and measure them accordingly?

Sadly, all indications points to the second option.

Market Speculators - Summary:

Green It Baby, One More Time!

If all these talks about the prices of energy and gas made you upset or depressed, and you think to yourself “well, that’s the reason why we move to green energy”, this part will make you truly sad.

Is The green energy revolution really working? Is it really saving the environment? Allow me to challenge your belief system.

Let’s start with two documentaries.

HEADWIND

Former London banker Alexander Pohl worked for years for one of the world's greenest banks. Idealistically driven he financed big wind and solar farms genuinely convinced he was making the world a better place. Gradually he woke up to the fact that today's green is a broken system. He gave up banking and emigrated with his family to his little forest paradise in remote, northern Sweden. The dream was to get back to Nature, start an eco-farm and put as much distance as he could between his family and the industrialization of nature. Until….. A wind park was planned at the gates of his paradise garden. Documentarian Poels and Alexander Pohl are taking the journey together…. to ask questions and unravel the green wonderland to its true core…

PLANET OF THE HUMANS

Michael Moore presents Planet of the Humans, a documentary that dares to say what no one else will — that we are losing the battle to stop climate change on planet earth because we are following leaders who have taken us down the wrong road — selling out the green movement to wealthy interests and corporate America. This film is the wake-up call to the reality we are afraid to face: that in the midst of a human-caused extinction event, the environmental movement’s answer is to push for techno-fixes and band-aids. It's too little, too late.

Germany’s Maxed-Out Grid Is Causing Trouble Across Europe

“Northern Germany can’t use all the renewable energy it’s making. Neither can its neighbours.

The growing mismatch between Germany’s renewables capacity and the strength of its electricity network is leading to curtailment, crazy pricing and challenges for neighbouring nations.

Although Germany is generating record amounts of clean energy in the north, its grid is too weak to transport all the power down to load centers in the south — a longstanding challenge for the country that is only getting worse.

One of the most visible effects of this renewable energy saturation on the German grid is negative wholesale electricity prices, times when consumers are effectively being paid to use excess power.”

What Europe’s exceptionally low winds mean for the future energy grid

The same climate change we are being warned about, which was one of the major push for using wind energy, is causing the wind turbine not to work as they were suppose to, making countries that move into dependency on wind turbine to be left without the energy they need.

Through summer and early autumn 2021, Europe experienced a long period of dry conditions and low wind speeds. The beautifully bright and still weather may have been a welcome reason to hold off reaching for our winter coats, but the lack of wind can be a serious issue when we consider where our electricity might be coming from.

To meet climate mitigation targets, such as those to be discussed at the upcoming COP26 event in Glasgow, power systems are having to rapidly change from relying on fossil fuel generation to renewables such as wind, solar and hydropower. This change makes our energy systems increasingly sensitive to weather and climate variability and the possible effects of climate change.

That period of still weather badly affected wind generation. For instance, UK-based power company SSE stated that its renewable assets produced 32% less power than expected. Although this may appear initially alarming, given the UK government’s plans to become a world leader in wind energy, wind farm developers are aware these low wind “events” are possible, and understanding their impact has become a hot topic in energy-meteorology research.

Coal:

Germany: Coal tops wind as primary electricity source

In the first half of 2021, coal shot up as the biggest contributor to Germany's electric grid, while wind power dropped to its lowest level since 2018. Officials say the weather is partly to blame.

ESG Whistleblower Calls Out Wall Street Greenwashing

And let’s end up with “sustainable investing”

In the two years he spent running “sustainable investing” at BlackRock, the largest money manager in the world, Tariq Fancy was an evangelist for the idea that capitalism can help save the planet from global warming.

Now he’s an apostate, convinced that one of the fastest growth areas in financing is a sham. “It’s clear to me now,” he writes in a recent three-part essay in Medium, that my work “only made matters worse by leading the world into a dangerous mirage, an oasis in the middle of the desert that is burning valuable time.”

Green Illusion

At the end of the day, the ones who gained most out of the green energy movement were… well, you guessed it. Financial institutes. We, and the planet, are suffering.

The Russians Analysis

Remember that I started this article with the following statement:

”As I was trying to figure out what the hell is going on in the world, I stumbled upon a transcript of a meeting that took place in Russia last year, which was led by Putin.”

After all this LONG analysis, let us look at how the Russians see the situation.

On the 6th of October 2021, the Kremlin has uploaded the transcript of a videoconference that Vladimir Putin conducted, and they called it “Meeting on development of the energy industry”. You are about to read direct quotes from the meeting, and now you can judge by yourself if the Russians were right or wrong.

Vladimir Putin:

“European countries’ underground storage facilities dwindled as a result of the harsh winter in early 2021. Over the last 10 years, Many countries in the region have given up their coal-burning and nuclear power plants in favour of wind power generation that is heavily dependent on weather conditions.

The former European Commission… activities were aimed at curtailing the so-called long-term contracts and at transitioning to gas exchange trading. This policy is erroneous. Consumers, including, for example, fertiliser producers, are losing all price benchmarks.

Gas price Today it is approaching $2,000 per thousand cubic metres of gas, which is over ten times last year’s average price.

I would like to underscore that Russia has always been a reliable supplier of [natural] gas to its consumers all over the world, both in Asia and Europe. Russia always fulfils all its obligations in full – all its obligations, I would like to stress this.

The Federal Republic of Germany is Russia’s biggest European consumer.

we have to pump 40 billion cubic metres of gas through Ukraine’s gas transit system per year. It is much cheaper to supply gas using the new pipelines, saving us about $3 billion per year for the supply volumes in question. The new pipelines (THE PLANNED NORD STREAM 2) can reduce CO2 emissions 5.6 times thanks to their new equipment.

The current situation on the European energy market is another clear example of the fact that hasty, let alone politically influenced decisions are unacceptable in any sphere, but especially so when it comes to energy supply on which the sustainable operation of enterprises and the welfare and quality of life of millions depends.”

Deputy Prime Minister Alexander Novak:

“The crisis that is unfolding in Europe and Asia related to the European politicians’ choice of spot contracts over long-term ones and a faulty forecasting of the supply and demand balance in their countries. since 2013 gas production has slumped by 10 percent in Norway and by 70 percent in the Netherlands, which used to be a major supplier in Europe.

It began last summer, when the United States reoriented its LNG supplies towards Latin America. HOWEVER, I would also say that market speculation, which are driving the prices up, are very strong as well. This most likely calls for an investigation into the activities of stock market speculators, because objectively the current price does not reflect the current situation.

Such prices are not good for the gas market. Many enterprises, especially gas chemical ones, may have to shut down in these circumstances, which is already taking place, as we can see happening in Britain and several other countries in Europe and elsewhere.

there are two factors, which could cool off the current situation: Nord Stream 2 pipeline, (and) gas should be traded on the electronic stock market in St Petersburg, which would reduce the effect of market speculation.

Vladimir Putin:

“the proposal to switch to an exchange trading system for natural gas came from the European Commission experts under the previous mandate, mostly from British experts. Where are those British experts with their proposals now? We know where they are, but consumers in continental Europe have been left to suffer from these initiatives.

Exchange trading in gas is not effective since it carries multiple risks, and we have always told them.

After all, this is not like trading in watches, underpants or ties, or cars; it is not even like oil, which can be produced and stored anywhere, including in tankers, waiting for the market situation to clear up. Gas is different, since it cannot be stored this way. Even LNG has to be produced, liquefied, loaded into tankers, delivered and then converted back into gaseous state. This is a costly and complex process. It does not work like that.

What we are seeing today is the result of their persistent or, to put it bluntly, careless actions, to say the least, with dire consequences for the market.

As I have already said, Gazprom saves about $3 billion per year on its new pipelines because it uses the latest pumping equipment and new pipes, so pressure can be higher, which is impossible for Ukraine’s gas transport system. It has not undergone any upgrades for decades, and any of its pipes can burst at any moment or some other accident may happen. Should this happen, everyone will suffer, including the transit operator and the consumers.

I remember the discussions within the European Commission, and I have been to Brussels myself. Talking to the so-called experts was not easy, since they tend to take a somewhat snobbish attitude and believe that their opinion is the only right one, and do not want to hear anything else. I hope that this time something will change.

it would be economically more profitable for (us) to pay the fine imposed by Ukraine in order to be able to increase the gas flow volume via the new systems. the pressure in the [new] pipe is higher, the CO2 emissions are lower, and the overall costs are lower by around $3 billion per year. But I have asked them not to do this. We must fully comply with the contractual obligations regarding the transit of our gas via Ukraine, through the Ukrainian gas transit system. First of all, nobody, including Ukraine, should be placed in a difficult situation despite all the factors at play in the Russian-Ukrainian relations today. And second, we must not undermine trust in Gazprom as a reliable, absolutely reliable partner in all regards.

CEO of Inter RAO PJSC Boris Kovalchuk:

As of today, the overall electricity price growth in Europe is practically 1,000 percent. This compares with 4 percent in Russia. Germany is at the forefront of efforts to reduce CO2 emissions. However, what is really happening? The price in Germany is 10 times higher, while coal-fired stations account for 27 percent of the country’s energy mix, compared to 13 percent in Russia. it is strange when you fight for carbon neutrality with prices that high and twice the share of coal in the energy mix compared to the Russian Federation. only 3 percent of the 60 GW obtained from renewables, mostly wind, will be available on the German power exchange tomorrow. In fact, a quarter of Germany’s energy system is not working.

Ukraine is mostly powered by nuclear stations.

In Germany, government agencies produce video clips telling people how to spend winter without lighting or heating, how to put candles into flowerpots to warm up a room, and how to make windows draft-proof with duct tape and cling film. Just a few years ago now, this would have been impossible to imagine, as if the stone age was back …

Vladimir Putin

*Yes, you were quite right to ask how they can fight for carbon neutrality, if the share of coal in the energy balance in Europe, and in this case we are talking about Germany, is twice as high as in Russia? Well, it turns out they can. This is what they, I mean the Europeans, are doing and trying to do at someone else’s expense. In this case, they are trying to do this at our expense, at the expense of the Russian Federation. I really do hope that we will be able to launch a dialogue on this subject, taking into consideration the interests of all sides on the global energy market.

+++++++++++++

If you read everything so far, you understand that EVERYTHING the Russians were saying was true:

The European Commission decided to move to short term contracts.

The Russians tried to tell them this is a bad idea.

The Commission’s representatives refused to listen.

The market is being manipulated by speculators.

Germany’s energy system is failing.

The EU “green policy” is a lie, that they use more coal and cause damage to the environment.

Trust the Russians?

About the claim that Russia was always a reliable supplier, allow me to quote from an article called “Gas pipeline co-operation between political adversaries: examples from Europe” which was written by the same Professor Jonathan Stern who wrote the article to the Financial times that you read at the beginning of this LONG article.

“In 1970, a 20-year contract was signed between the Soviet foreign trade ministry and the West German company Ruhrgas for the delivery of gas to the FRG (West Germany)…In 1973, the FRG received its first gas deliveries from the USSR…Soviet gas exports to Western Europe – and especially to Germany – were the subject of major and repeated controversy between the United States and its European allies during the period 1960-90…natural gas pipeline cooperation was possible even between former political adversaries. In the German case, gas trade commenced even before the political problems between the countries were resolved… Successful, even if limited, gas trade between political adversaries is possible even with no significant improvement in political relations”, and as was mentioned in another website, “Even in the worst periods of Cold War, the USSR did not use the leverage of gas pipelines in its political interests.”.

PUTIN WAS RIGHT.

WHY?

When I surfaced out of the rabbit hole I fell into, I realised that:

Vladimir Putin seems to care about European and the European economy more than the European leaders. He also seems to be more reliable than the European Commission and/or the other European “leaders”.

Decision making related to energy in Europe seems to be driven by some sort of ideology, which is very different from the values that the European Commission was and is telling the Europeans it follows.

No one wants to talk about the control of the financial institutes and the huge profits they and their clients are making out of the energy crisis.

The European energy regulator and the financial regulator which are in charge of the energy market and the energy exchanges have little knowledge, or perhaps even worse, have knowledge but do not share about what is actually going on in the energy market.

Like the EMA and their decision not to perform risk analysis of the risk that raises from specific technologies (Codon Optimization), the regulators are not performing any risk analysis to the dangers of AI/machine learning on the energy market.

There is a huge distance between reality and what was and is being told to the European about the energy market. The stories that Europe has a competitive market that drive prices down and bring stability, the stories about how green energy is good for the environment, the stories about sustainable investments, all stories. And again - who profit from it? Big financial institutions.

So why?

Sustainable Development Goals

I told you before about the European “energy packages”, and I said that we are on the 5th edition. Here is what the EC wrote about it: “The fifth energy package, ‘Delivering the European Green Deal‘, was released on 14 July 2021 with the aim of aligning the EU’s energy targets with the new European climate ambitions for 2030 and 2050; the debate on its energy aspects is ongoing.”

Instead of thinking of the current events, including in Ukraine, as a some sort of a development that no one could have foreseen, Let us look at the UN’s 2030 Agenda, which the European Commission is pushing without even asking anyone in Europe if they want it or not. I added my own understanding to each and every one of the points in the agenda:

Goal 1: No poverty - with the rising energy prices, people are being driven into poverty

Goal 2: Zero hunger (No hunger) - after years of pushing Ukraine into a conflict with Russia, and knowing that a conflict with Russia will cause a huge risk in food costs, hunger will be increasing at rapid rate.

Goal 3: Good health and well-being - If it was not unusual to bury a report that warned against destabilising the energy market, why do you think it will not be unusual to bury a report that the experimental gene therapy are unsafe? In both cases it impacts human lives, and the European Commission already demonstrated that it cares more about the indemnification of the vaccine manufacturers than for the health and safety of European Citizens.

Goal 4: Quality education - nothing says quality education like telling little kids that biological sex does not exists. science is dead, long live scientism!

Goal 5: Gender equality - transhumanism in disguise.

Goal 6: Clean water and sanitation - isn’t war the greatest thing in the world when it comes to clean water and sanitation of the people who are living in it?

Goal 7: Affordable and clean energy - I think I’ve covered it enough this article!

Goal 8: Decent work and economic growth - there is no economic growth if you have no energy. There is no decent work when your government destroys small and medium businesses but allow big corporations to take over our economy.

Goal 9: Industry, Innovation and Infrastructure - wait to the upcoming cyberattack, and then get ready for your Central Bank Digital Currency. China’s social credit score system is coming everywhere on earth, and it is coming fast.

Goal 10: Reduced inequality - well, they are going great in this - pretty soon everyone (except “the chosen ones”) will be poor!

Goal 11: Sustainable cities and communities - they want to move everyone to the cities so they can monitor all of us 24x7

Goal 12: Responsible consumption and production - you are not allowed to travel unless we tell you. You are allowed to eat only what we tell you that you can eat and not more than the quantities we tell you.

Goal 13: Climate action - we are about to use airplanes to make the sun go away to reduce the temperature. Don’t worry, darkness is good for you!

Goal 14: Life below water - our oceans are being polluted at an alarming rate, and while we been told plastic straws kill the life at the oceans no one talks about the damage the face masks is causing.

Goal 15: Life on land - nothing says life more than a war, isn’t it?

Goal 16: Peace, justice and strong institutions - War is peace, atrocities are justice, and totalitarian regimes are a sign for strong democracies, isn’t it?

Goal 17: Partnership for the goals - we will tell you what we decided you must do, and you better partner with us!

We are being told/sold one thing, while we are being delivered the complete opposite. Who is gaining from making all of us poorer, from stripping away our freedoms? You guessed it, the rich and powerful. The Davos clan. The members of the World Economic Forum cult, head by Klaus Shwab. The followers of scientism, who worship power and money and technology, the golden calf followers of our generation.

Whatever we experience was planned for a long, LONG time. The end game is… the end of our democracies and enslavement of the human race to be dominated by those who follow the cult of scientism.

FINAL THOUGHTS

The great reset is here.

The European Commission leadership, as well as other “leaders” in western democracies try to shift the blame from the fact they orchestrated everything, that what we experience right now is a planned ideological assault of the citizens of Europe, that they were igniting a conflict in Ukraine FOR YEARS and that now they make it even worse by sending weapons. The leaders of the European Commission, who talk about the pain that "we" might experience as a result of the "moral stand" Europe is taking, are playing a cynical game with the lives of Europeans. Next they will blame the Russians for cyberattacks on our infrastructure.

How come none of the European leaders speaks about it? Is it because they don't know, or because they are all committed to The Great Reset more than they are committed to the people they were supposed to represent? The Great Reset is a war against humanity.

The saddest thing about the way people in the west react to what's going on in Ukraine, is that they haven't learned anything from 2020, that they cannot see the mass propaganda campaign and how same tactics are being used once again. We AGAIN follow the Pied Piper of Hamelin. Zelenskyy is being portrayed by our leaders and the media as a man who represents freedom, the same way Fauci was being portrayed for the last two years as a man who represents science, while in fact it is as if someone was calling the antichrist "our lord and our saviour".

DO NOT FOLLOW FALSE PROPHETS!!!

I remember the time that people in the left, liberals, were anti-war. Remember John Lennon? We now live in a war that a person who works in a network that is associated with the conservatives / "the right" is the one who is giving an anti-war monologue, while the establishment on both sides of the political spectrum are calling for more and more escalations and violence.

IT IS TIME TO FORGET THE FALSE SEPERATION WE HAVE BEEN INDOCTRINATED WITH.

SAY NO TO WAR !!!

Do not stand "with" Ukraine.

Do not stand "with" Russia.

Do not stand "with" any country, or government, or leader.

Do not be fooled by your ego, who thinks there is a "you" and "I".

SURRENDER TO THE TRUTH.

SURRENDER TO LOVE.

SURRENDER TO YOUR TRUE SELF.

SURRENDER TO THE NOW.

.

.

.

I AM THE LOVE THAT IS YOU.

EHDEN

Wow! A very powerful and informative essay, backed by a wealth of actual information.

Many of us can smell the odour of corruption around this war in the Ukraine, and can see how NATO and the puppet masters are inflaming it - but this in-depth analysis of the energy market is brilliant - and very alarming.

I pray that you are protected in the Light, Ehden, as the warlords continue to beat the war drums and the situation escalates as we watch in horror from the other side of the world.

Brilliant. On my 3rd reading....